Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Great Start: The S&P 500 has returned +11.5% YTD as of 2/28/19. In the last 93 years, this is the 6th best start to the year and the best since 1991. The average calendar-year S&P 500 return following positive January/February returns is +17.0%. (Source: BlackRock)

- Bull Decade: The S&P 500 has not experienced a bear market drawdown of 20%+ since February 2009. As such, the impact of the financial crisis is no longer included in 10-year return statistics for the S&P 500 with an annual average return of +16.5% as of 2/29/19. Prior to rolling off the worst part of the financial crisis, 10-year average annual S&P 500 returns were +10.2% as of 6/30/18 and +8.5% as of 12/31/17. (Source: BlackRock)

- Financial “Experts”: More than 30 Wall Street economists have attempted to predict the year-over-year direction (higher or lower) of the 10-year U.S. Treasury Bond interest rate in an annual survey conducted since 1992. During this time, they have correctly predicted the direction only 45% of the time with an average amount of error of 0.65%. As of March 7, 2019, the 10-year Treasury is 2.64%. Assuming an average prediction error, based on the current rate, the “experts” will miss by 25%. (Sources: BlackRock, Philadelphia Federal Reserve)

- Americans Don’t Cheat on Taxes: Despite the IRS auditing under 1% of U.S. tax returns, most Americans feel obliged to pay their income taxes with 88% responding to an IRS survey that “it is not at all acceptable to cheat on taxes”. Other data confirms this with America’s “Voluntary Compliance Rate” (VCR) being over 80%. For comparison, Italy’s VCR is 62% and Germany’s is 68%. (Source: The Atlantic)

- Mr. Burns Approves: U.S. Bank Stadium in Minneapolis, host of the 2019 NCAA men’s basketball tournament’s Final Four, is installing $4.6 million of curtains to block the sun and keep lighting consistent. (Source: Bleacher Report)

Thought for the Month

“I love where I come from. The people there are good people. When they say, ‘Thank you,’ they mean it.”

– Luke Perry, American actor, best known for playing Dylan McKay on the TV series “Beverly Hills 90210”, born in Mansfield, OH and raised in Fredericktown, OH (1966-2019)

Commentary – Tax Refunds as a Savings Tool?

A recent posting from the Tax Policy Center highlights a perplexing trend: many Americans use tax withholding from their paychecks as a savings tool. Withholding too much income tax from your paycheck only to receive it months later in the form of a tax refund is, in short, asinine. Delaying receipt of dollars to which you are entitled, and not receiving any sort of interest earnings is foolish, even considering today’s prevailing low interest rates that could be earned if these dollars were simply held in a savings account.

In 2017, the IRS issued almost $437 billion in refunds to nearly two-thirds of all filers and paid an average refund of almost $2,700. Of low- and moderate-income tax filers, 80% say they consider withholding too much to be a savings tool. Many also report “it feels good” to receive a refund check rather than having to pay “additional” money to Uncle Sam upon tax filing. Whether you’re simply not paying attention, fooling yourself into saving, or to make yourself feel better, the reality is that, at the very least, you’re intentionally foregoing potential interest income and cash flow flexibility throughout the year.

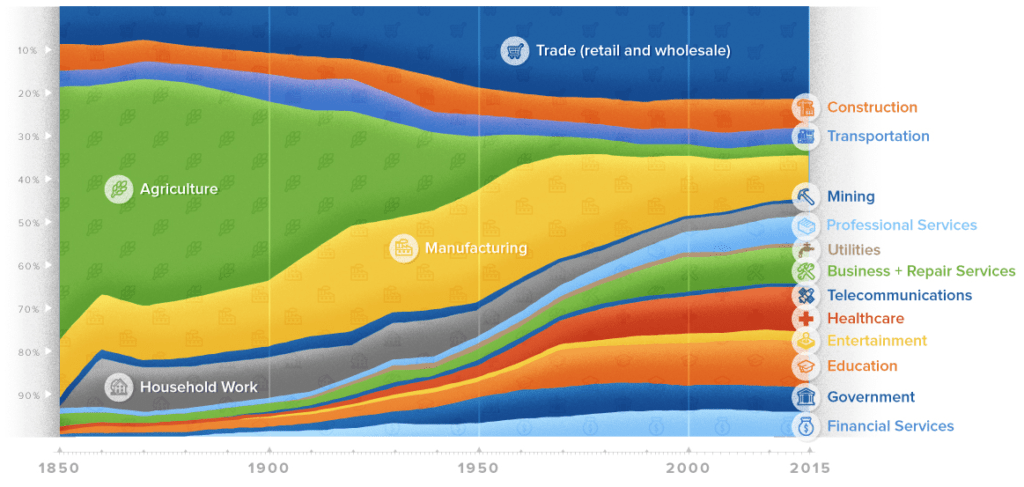

Chart for the Month – 150 Years of U.S. Employment History

Over the last 150 years, the job landscape shifted dramatically in the United States. In 1850, agriculture’s share of U.S. employment was close to 60%, but today farming represents just 3% of jobs. Only 60 years ago, manufacturing represented 26% but has dropped to under 10%. While the distribution of jobs has changed over time, new jobs have developed in other sectors as new technologies disrupted prevailing industries. With ongoing advancements and the inevitable evolution of our economy, future job opportunities are certain to look vastly different whether it be careers as a social media influencer, robot repairman, or intergalactic diplomat.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.