Posted: 06/12/2024

It’s already June! Let’s see where we stand in the stock and bond markets heading into the middle of the year.

Stocks

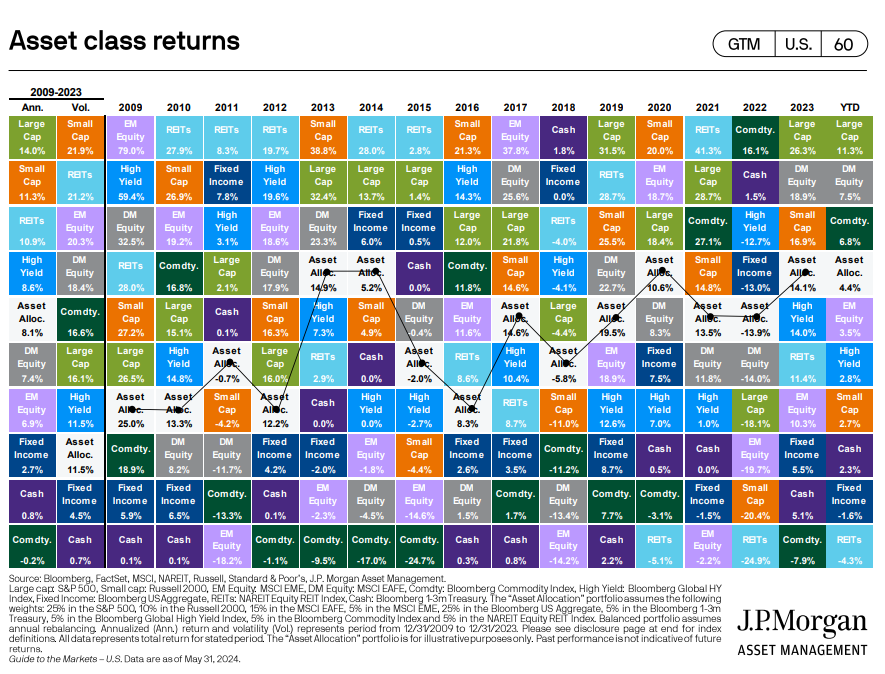

Pretty good! US large cap stocks, represented by the S&P 500 index, are up 11.3% as of May 31. If we think about the average annual S&P 500 return being about 10%, I’d say we’re in a great spot already! Large cap has led the way in the US with mid- and small-cap up 5.7% and 2.7%, respectively. International stocks are no slouch, either. Developed market equities (Japan, Canada, most of Europe, Australia) have returned 7.5% through the end of May with Emerging markets (China, India, Taiwan) having returned a respectable 3.5% in the same time.

The stock market has been resilient this year, seemingly ignoring the overall pessimism surrounding interest rates and inflation. Consumer confidence is still climbing after 2022 lows and there have been 23 million more people through a TSA checkpoint this year compared to the same point in 2023. Inflation has been controlling the news cycle all year, but not the markets. While interest rates and inflation may be impacting households’ bottom line, investment accounts are still growing. From the perspective of the stock market, day-to-day headlines and short-term noise is just that, noise.

Bonds

The conversation around bonds is still dominated by interest rates as a result of sticky inflation. At the beginning of the year, many experts expected inflation to continue its downward trajectory toward the Fed target of 2%, which in turn would allow the Fed to start cutting interest rates, sending bond prices higher. As many know, that has not happened. Inflation has come down a bit, but not enough to warrant any rate cuts and thus there has been very little movement in the bond market. Higher bond income has helped to alleviate some of the price volatility, but still the US Aggregate bond market is down -1.6% on the year.

Despite the year-to-date negative return and the poor performance of 2022, bonds have produced annualized returns of 2.50% dating back to 2009. The return has been outpaced by inflation over the same 15 years (3.40% annualized inflation to the 2.50% bond return) with most of the excess inflation coming since 2022. In today’s environment, bonds still deserve a place in a diversified portfolio, especially with the consideration that rates are expected to be cut in the near term.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.