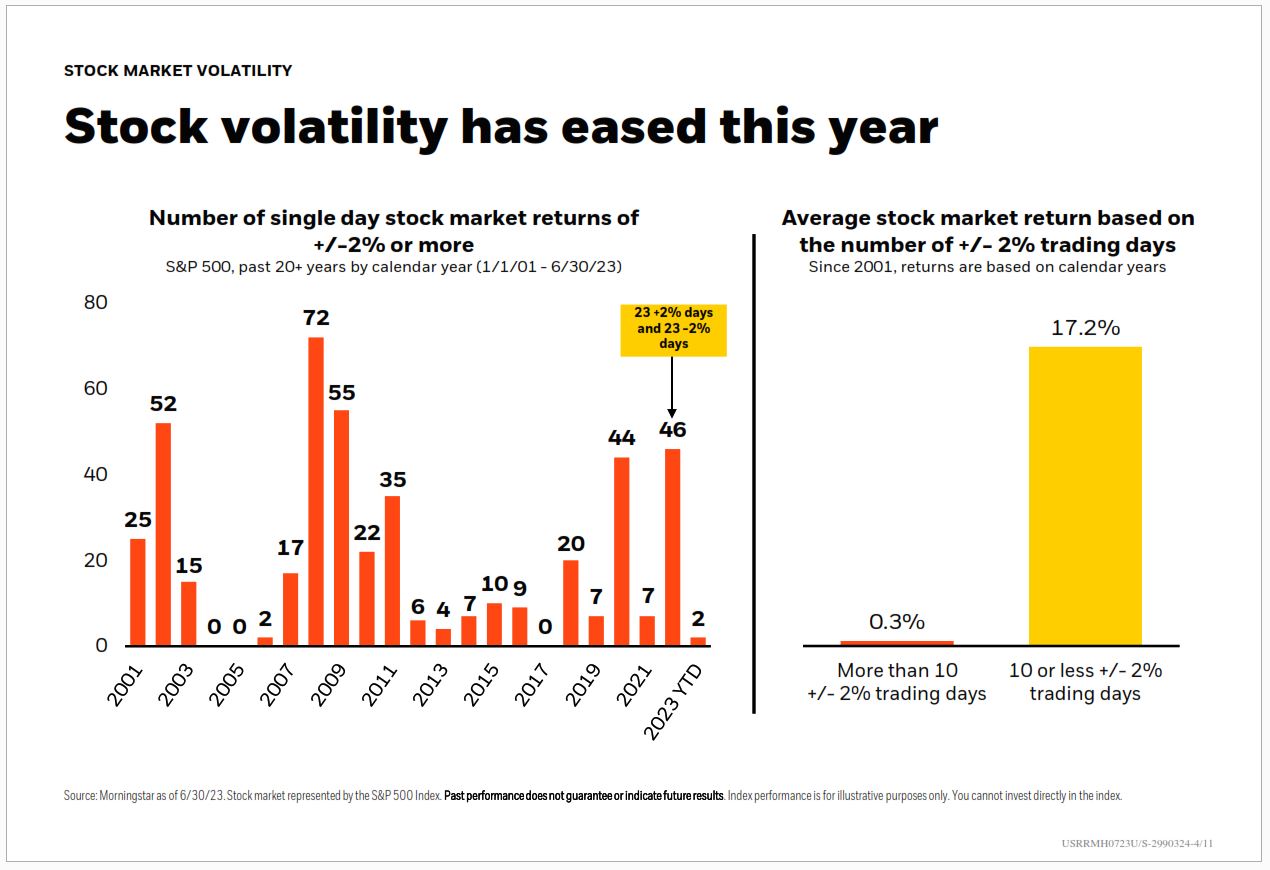

Volatility is defined as “the degree of variation of trading price series over time” and is often synonymous with general stock market risk. If volatility is increasing, investors can expect their returns to fluctuate a great deal more, usually to the downside. Last year is a great example of high volatility; there were 23 days in which the S&P 500 posted a single day return greater than 2% and 23 days in which the S&P 500 posted a single day return worse than -2%. In total, 46 days of +/-2% change in price. Looking at the chart below can help put that number in context.

2022 produced more volatile days than the 2020 Covid pandemic, more days than in 2011 when the US lost their triple A credit rating while a European debt crisis loomed, but just less than 2009. The expectations for 2023 were more of what 2020 and 2022 had to offer. And, considering what the economy has challenged with – interest rates, inflation, debt ceiling, chances of a recession around the corner, it seemed like a realistic expectation. But as I’m sure you noticed already in the chart above, stock market volatility has been nearly non-existent.

There have only been 2 days this year in which S&P 500 returns have been +/-2% in a day, as of June 30th. Compared to last year it’s certainly a breath of fresh air! The BlackRock chart also provides a look at average market returns during volatile years (more than 10 days of +/-2% trading days) and years with low market volatility (10 days or less). The contrast is stark; the low volatility years have averaged a 17.1% return where the volatile years have averaged only 0.3%.

Like I mentioned above, volatility is usually greater when there is added downside risk in the markets resulting in more or bigger down days. This could explain the average returns on the right side of the chart.

The markets have continued to trend upward, and we are thrilled with the comeback after a tough 2022. PDS is continuing to monitor client accounts and the broader market for rebalancing, tax loss harvesting, and other areas of opportunity. We hope everyone is having a wonderful summer and the sunny weather continues!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.