July 2022 PDS Planning Market Commentary

We’ve made it to the halfway mark and only two asset classes have posted a positive return – commodities and cash. But the case can be made cash is only positive on paper since yields are well below the current inflation measures. It’s easy to see the markets and economy have been facing an uphill climb so far, and the next stretch doesn’t look much easier.

Real gross domestic product [GDP] decreased 1.6% over the first quarter of 2022 and at the end of July, we’ll get the first official look at quarter 2. Unfortunately, the Atlanta Fed’s GDPNow is estimating a second consecutive quarter of negative GDP. And if we’re using the book definition of recession, back to back quarters of declining GDP to signal a recession, the economy is dangerously close to entering one.

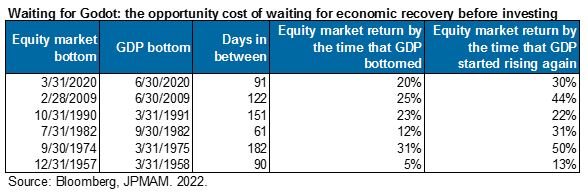

We don’t see this as a sign to get out. JPMorgan’s Michael Cembalest explained that equity markets lead the economy by several months, sometimes more. Because of this, the markets usually reach a bottom before the economy (GDP). He goes on to provide data on the opportunity cost of waiting for economic recovery before investing. On average, there are 161 days between the stock market bottom and GDP bottom based on the last 6 recessions. In those 161 days, equities return near 19% on average. If an investor instead waits until the economy turns positive, they would have missed 32% in equity returns.

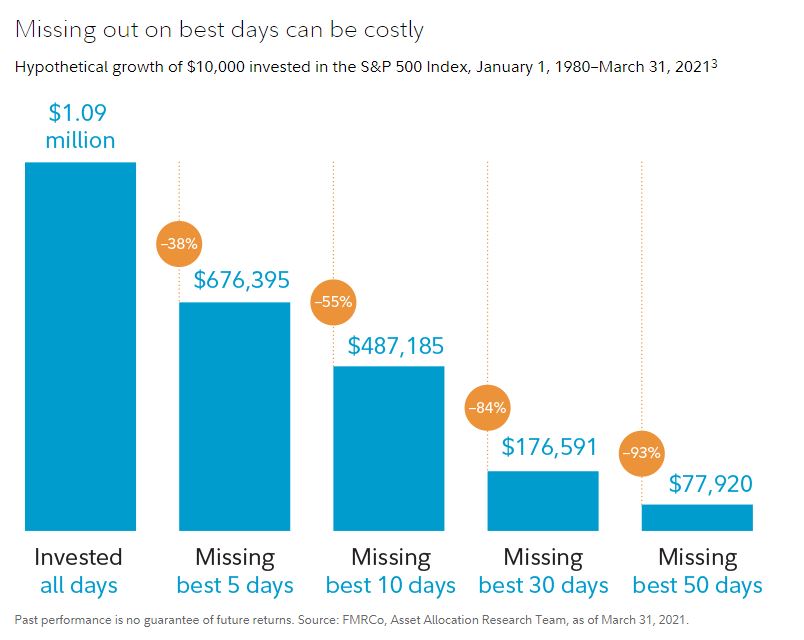

This helps show how quickly the stock market can change direction, even during times when consumer confidence is low. To further emphasize the point and show the power of staying invested, Naveen Malwal with Strategic Advisers explained, “a hypothetical investor who missed just the best 5 days in the market over the past 4 decades could have reduced their long-term gains by 38%; someone who missed the best 10 days could have undermined their gains by 55%.”

As the Fed continues to fight high inflation and supply chain bottlenecks remain (among other things), market prices may continue facing headwinds as investors fear a possible impending recession. Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” While it may not be time to throw the book at equities, we urge our clients to stay the course. Remember, today’s headlines and tomorrow’s reality are seldom the same.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.