Imposter Syndrome – Debunked

Being a trusted advisor to our clients, I must admit from time to time I suffer from Imposter Syndrome, summarized as a condition that leads one to fear their success is a result of luck, in turn deceiving others into thinking they are more intelligent than they perceive themselves to be. i.e. Why would someone pay me to give them advice? (FWIW, I have an overbearing sense of Imposter Syndrome every time I look at my wife and wonder what she’s doing with me!) I also couple that with the fact I believe many people are capable of being their own advisor. Don’t believe me? I wrote about it here. However, these past few months have reminded me that (good) advisors do provide value.

Reacting to Financial Markets Emotionally

When markets are humming along (2009-2019), clients and Do-It-Yourselfers (DIYers) have an abundance of confidence, often discounting potential risks on the horizon, leading to sometimes reckless decisions around money. Advisors, though mistakenly lauded by clients for doing such a great job on the portfolio, become anxious as clients become less concerned about the counsel they receive related to financial planning. Conversely, when markets fall at a precipitous rate (2007-2008, 2020), client confidence is converted to fear and panic, leading to unintentional emotional decisions around money. Clients and DIYers often exhibit Recency Bias when making decisions, driven to believe that what recently happened will continue to happen. So the panic and fear manifests itself for a period of time that usually exceeds the start of the market recovery.

How Much Value Can a Professional Financial Advisor Add?

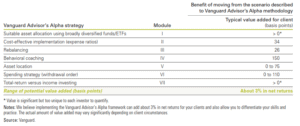

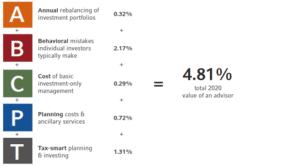

The truth is, (good) advisors provide value at all times. Can that be quantified? Maybe. Companies have been building research papers for years now trying to distill down to a number, expressed as an excess return percentage that advisors provide. They call it Advisor Alpha. Vanguard and Russell Investments have done extensive research on this concept and arrived at similar conclusions. They both agree that several practices of (good) advisors focuses on some routine best practices, such as portfolio rebalancing, financial planning that drives portfolio allocation recommendations, tax management and planning, and the big one – behavioral coaching. Their conclusions suggest the Advisor Alpha has a value somewhere between 3% and 4.8% annually!

Managing Emotions to Allow Logic to Prevail

Though they place different values on different components, they agree that one of the most valuable services offered by an advisor is the ability to help clients navigate the complex web of emotions that comes with investing one’s own money. The stakes are high because if emotion is allowed to cloud judgment, it can have a dramatic impact on the outcome.

At PDS I know the time and effort we put into our client’s financial plans, portfolio decisions, and tax planning. These things are tangible and yield benefits for our clients. I also know, and have been expressly reminded of late, the effort we put into helping our clients manage their emotions, especially during more volatile periods like this year. Anxiety and fear are powerful forces. So too is logic, if we allow it to be.

Though I won’t try to personally quantify it, Advisor Alpha is a real thing. So too is Imposter Syndrome, the benefit of which is the motivation it provides me to be the best I can be for those who have trusted me with the responsibility to help them achieve their goals.

It’s your life. Let’s plan for it, together.

Jamie

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.