Your records hold some of your most valuable and private information, including social security numbers, health and financial information, and property records. Because too much paper can cause stress and disorganization, it is important to be clear about what you need to keep and for how long, and what can be destroyed.

Every financial decision seems to come with a trail of financial documents, and the same is true when you buy, sell, or insure something. And as tax season comes and goes, there is sure to be another stack of documents to add to your files.

Why It Is Important to Keep Financial Documents

Even though it may seem as if the whole world is going digital, the reality is there are a number of physical documents that individuals must be able to provide to various companies, regulators, or government agencies for one reason or another. Ensuring that you save the proper documents for the necessary time frame remains important.

For instance:

-

- Failure to maintain proper records can result in IRS tax penalties in the event of a tax audit.

- When applying for a loan, if documents are not readily available, a borrower may miss an opportunity to lock in a favorable rate, qualify for a mortgage, and/or lose out on making the desired purchase altogether.

- If the validity of ownership is ever challenged, deeds and other title documentation may be needed to prove legal ownership of an asset.

- In litigation or other legal disputes, defendants (or plaintiffs) may need certain documents to prove their case or claim.

Unfortunately, there is no hard-and-fast rule about what documents should be retained (or not). The process of figuring out what to keep and what to shred depends on the nature of the document and what it will be used for.

How Long Should You Keep Financial and Tax Documents?

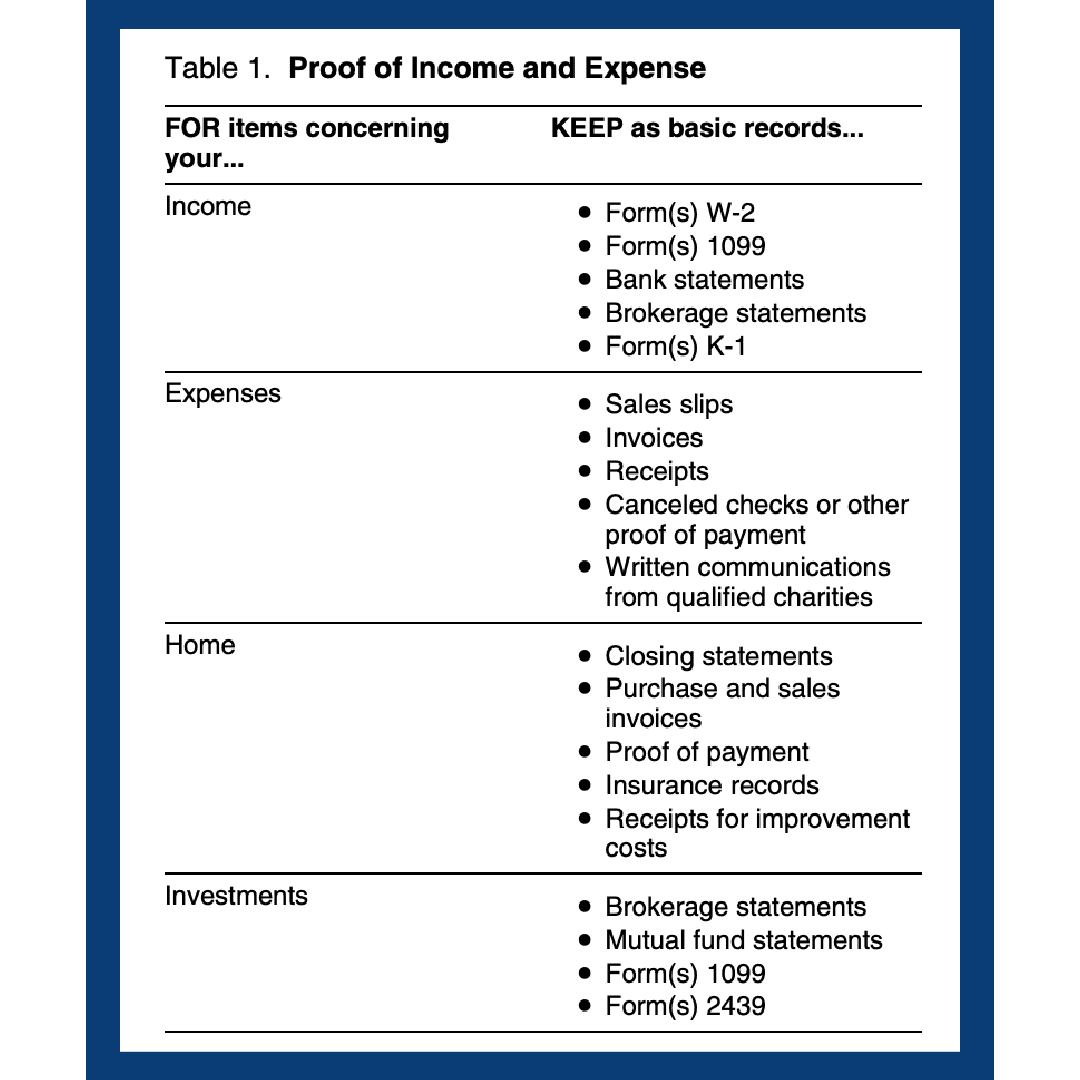

Generally speaking, the primary reason for saving financial documents is to be able to prepare – and to defend, if necessary – your annual tax returns. You’ll want to keep a permanent electronic or hard copy of the seven year’s worth of tax returns, at least. Plus, record of any payments you make to the government as part of your financial history. Additionally, it’s a good idea to hold on to records of major financial events, such as legal filings or inheritances.

It is also important to keep the documents that verify the information in your returns, such as W-2s, 1099 forms, receipts, and payments. Just like the full tax return, it’s recommended these documents are kept for at least seven years. Even if your records are no longer needed for tax purposes, you may want to verify that the documents aren’t needed for other important financial institutions. Your insurance company or a creditor may have different record-keeping requirements than the IRS.

Bookmark this online resource, Publication 552: Recordkeeping for Individuals from the IRS for future questions or reminders.

How Should You Store Financial Documents?

Now that you know which records you need to keep, it is time to determine the best place to do so. Depending on your personal preference or space limitations, you may prefer to keep virtual records of important documents rather than physical versions. Though, some records still need to be stored physically. While the IRS accepts digital records, some government agencies and businesses may still require original documents.

Physical Documents

A filing cabinet, large binders, or fireproof boxes are a few good options for storing large amounts of records. Be sure to keep extra copies of the most important documents in a different place in the event that the original gets misplaced. When establishing your filing system, make it easy to understand so that others can find important documents, if necessary.

Digital Documents

For added security or to free up space, keep an electronic copy of all of your documents as a backup. This is a good option for those records that you need to keep, but don’t regularly use, or need to access. Paper documents take up a lot of space, so digitizing even part of your records can help eliminate clutter, and help make your filing system more organized.

Cloud-Based Storage

Cloud-based storage offers an easy way to save your folders and files, like any scanned documents or images. This protects against hard drive failure or other similar issues and also allows users to access these same files on the go from a mobile device. But many question whether it is safe to store digital documents online. The short answer is yes. However, be sure to choose a platform that has the protection necessary for your personal information.

Always take precaution to protect your account with a strong, unique password and set up two-factor authentication (or biometrics if an option). Don’t stay automatically logged in on all your devices, and be sure to set up alternate contact information in case your account is hacked. Also, look for advanced encryption technology and stay alert for scams.

A financial life necessarily involves a significant amount of documentation—from monthly bank statements to insurance documents to the various materials required to file your taxes. By learning what you need to keep and for how long, you can minimize the unnecessary clutter and keep the most important items at your fingertips.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.