The holiday shopping season is off to a record-breaking start. From Black Friday through Cyber Monday, shoppers spent $44.2 billion—up 8% from last year and well above expectations. Consumers are on track to spend $250 billion this holiday season for the first time ever. Contrary to what increased consumer spending typically signals, November consumer sentiment came in 40% below average and down 26% from last year. Americans are spending like they feel great, but they certainly don’t feel that way.

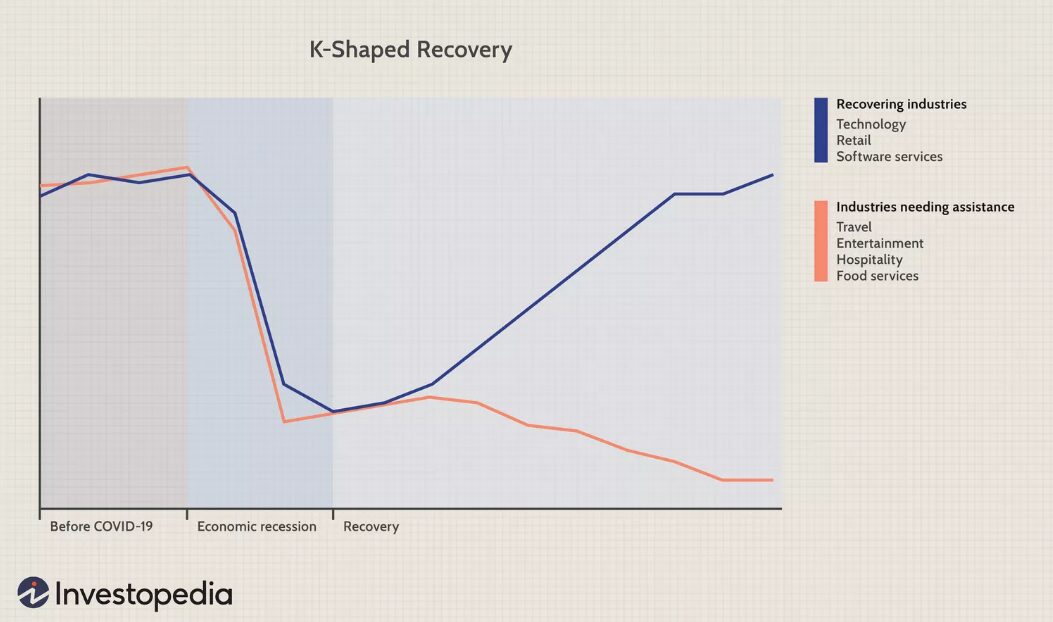

This paradox has brought new attention to the “K-shaped economy”. It’s a term being echoed more frequently by corporate executives, Wall Street analysts, and Federal Reserve officials. The idea is straightforward. The upper part of the K represents higher-income Americans watching their incomes and wealth climb higher, while the bottom part reflects lower-income households struggling with weaker wage gains and stubbornly high prices. A tale of two economies.

The framework helps explain an unusually confusing economic picture. Growth appears solid, yet hiring is sluggish and unemployment has ticked up. AI-related data center construction is soaring while factories lay off workers and home sales are weak. The stock market hovers near record highs, up nearly 15% this year, even as wage growth slows for many Americans. As Peter Atwater, an economics professor at William & Mary put it, “those at the bottom are living with the cumulative impacts of price inflation while those at the top are benefiting from the cumulative impact of asset inflation.”

The Wealth Effect is Real

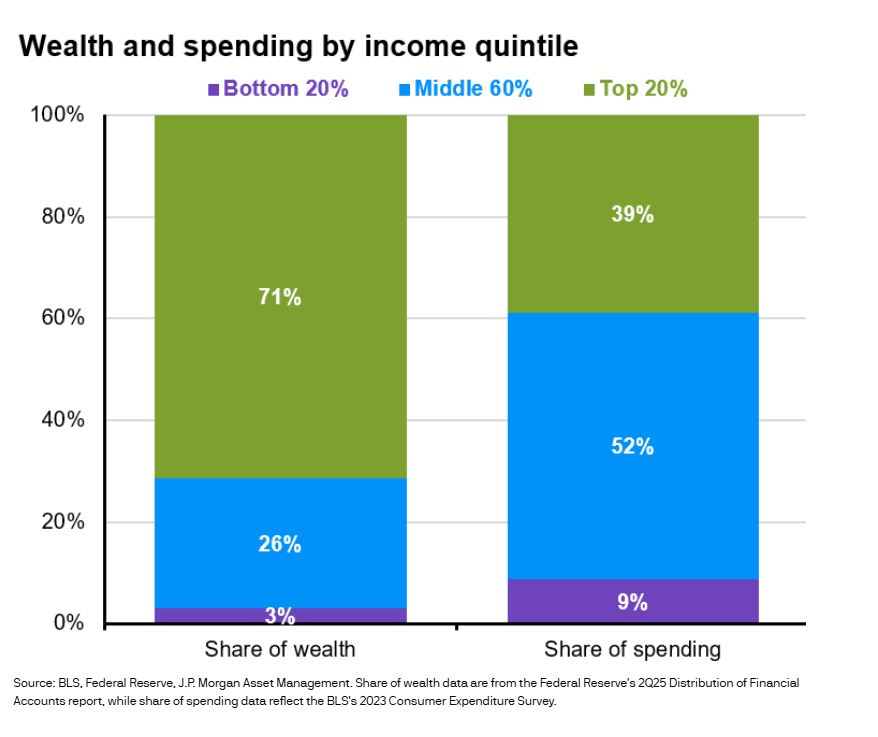

Stock and housing market appreciation has doubled the wealth held by the top 20% of households, fueling their spending and masking weakness at the bottom. In addition, the wealthiest 10% of Americans own roughly 87% of the stock market while the poorest 50% own just 1%. Meanwhile, lower-income families have seen inflation erode any discretionary budget, and cuts to SNAP and Medicaid combined with the resumption of student loan payments are compounding the financial pressure.

Corporate America is clearly paying attention but are still doing little. CEOs at Delta and Best Buy have commented on profits being fueled by premium products and big spenders, noticing a divide in consumers consistent with the K-shaped economy. But when it comes to higher profits or affordability, profits win.

Many consumer-facing companies have been warning about this slowdown since early 2023. Their customers are still willing to pay up for innovation and special occasions, but they’re increasingly seeking value, trading down, and postponing major purchases. The pressure is concentrated in lower-income households where discretionary budgets have been squeezed.

The Middle 60% Hold the Key

The real story sits with middle-income Americans—the 60% between the top and bottom. This group holds just 26% of total wealth but drives more than half of all consumer spending. Their continued resilience hinges on the labor market, and warning signs are starting to flash. Inflation-adjusted wage growth for lower-income workers has plunged to just 1.5% annually, well below the 2.4% gains for the highest earners.

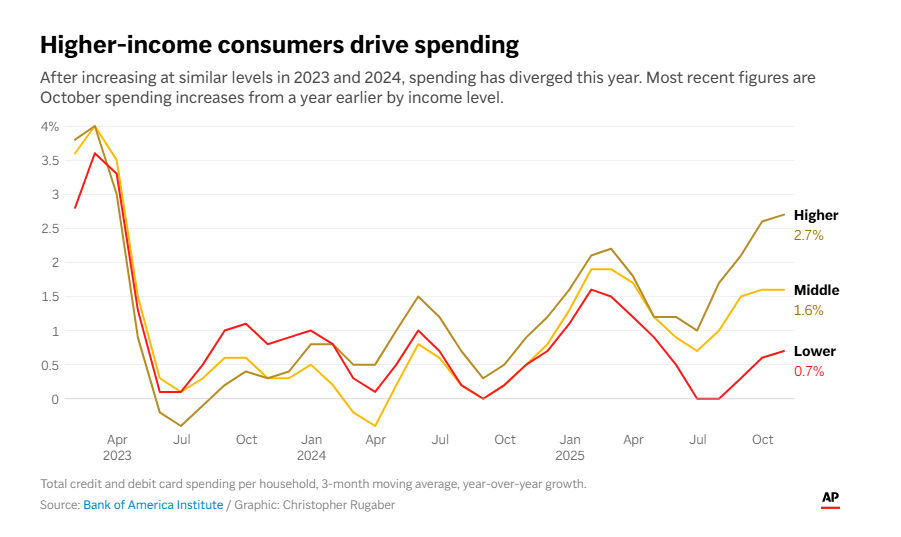

Financial institutions aren’t yet seeing meaningful stress in credit card delinquencies or bank accounts, which offers some reassurance. However, spending data from Bank of America shows higher-income households increased spending by 2.7% in October year-over-year while lower-income groups lagged at just 0.7%. That’s a significant gap and one worth monitoring.

While fiscal stimulus (rate cuts) should support spending through the first half of 2026, weak wage growth and a softer labor market could lead to a potential pullback later next year. Many professionals worry that an economy propelled mostly by the wealthiest isn’t sustainable over the long term. Should layoffs worsen and unemployment rise, middle- and lower-income Americans could pull back sharply on spending. That would eventually impact even the companies at the top of the K.

In most markets, there is good and there is bad and it’s important to be aware of both. The key for investors is staying diversified, maintaining portfolio quality, and considering increased exposure geographical diversification as we move into 2026. At PDS, we continue to monitor client portfolios for any rebalancing or tax savings opportunities and remain open to new and updated information so we can adjust our views accordingly.

We wish everyone a very happy Holiday Season!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.