December 2021 Financial Markets Commentary

“With less than a month left in what has been an extraordinary (and mystifying) year on multiple fronts, stocks have maintained a largely uninterrupted trek higher (at the index level) in the face of myriad headwinds—not least being the mid-year surge in the delta variant, supply chain disruptions on a global scale, surging energy prices, and an uncomfortable spike in inflation,” according to Schwab’s Chief Investment Strategist Liz Ann Sonders. “While that laundry list of concerns ultimately led to the S&P 500’s 5.2% drawdown in September (the largest since November 2020), the drop was quickly erased in 13 days, as investors embraced the weakness and preserved confidence.” Similarly, the Omicron variant caused another 5% decline in late November, but markets jumped back to near-record highs in just five trading days.

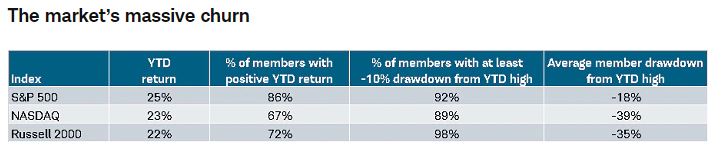

On the surface, it would appear that markets have experienced very little volatility in 2021. We barely had two -5% pullbacks, while an average year would include four of these. However, 92% of stocks within the S&P 500 have already had at least a -10% correction from their high, with the average drawdown around -18%. Fortunately, the “rotational nature of these corrections is such that rolling pockets of weakness have been offset by pockets of strength, which has kept the indexes’ declines more muted.”

With record high stock prices, inflation concerns and the Federal Reserve’s updated stance to taper their asset purchases and to start raising interest rates within the next 12 months, we view this as an opportunity to rebalance portfolios. The index level volatility has been muted this year, but we would expect this to pick up closer to normal levels again. We remind clients to maintain a diversified allocation and to keep their next 7-10 years of income needs from their portfolio in stable assets such as cash, CDs and short-term bonds.

As the year nears an end, we thank all of you for working with PDS Planning. We are very grateful and wish everyone a safe holiday season and a happy new year!

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

1.0% |

26.1% |

15.7% |

14.0% |

| S&P 400 Index – Mid-Size Companies |

-1.6% |

24.9% |

10.7% |

12.2% |

| Russell 2000 Index – Small Companies |

-3.3% |

20.8% |

10.7% |

11.7% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

-2.1% |

19.4% |

13.7% |

11.5% |

| MSCI EAFE Index – Developed Intl. |

-5.1% |

10.8% |

9.2% |

7.6% |

| MSCI EM Index – Emerging Markets |

-6.9% |

2.7% |

9.5% |

5.0% |

| Short-Term Corporate Bonds |

-0.6% |

0.4% |

2.4% |

2.0% |

| Multi-Sector Bonds |

-0.6% |

-1.1% |

3.7% |

3.0% |

| International Government Bonds |

-3.6% |

-6.9% |

1.7% |

-0.6% |

| Bloomberg Commodity Index |

-0.1% |

28.9% |

3.3% |

-3.3% |

| Dow Jones U.S. Real Estate |

-1.2% |

30.2% |

11.2% |

11.5% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.