Happy August and Happy Back to School month! Every year we get to this point, and every year I find it hard to believe we’re already here! My wife has been back in her classroom getting it ready for the 8th graders, and parents everywhere are ready for some semblance of a routine again.

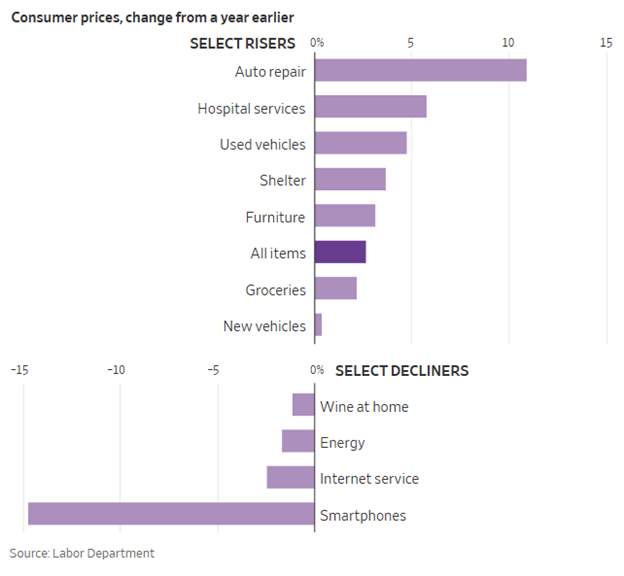

In the markets, July’s Consumer Price Index (CPI) increased 2.7% year-over-year, matching June’s pace and coming in slightly below economists’ forecasts. This stability in headline inflation was largely supported by price declines or stabilization in the categories most visible to consumers—shelter, energy, and groceries. These areas tend to carry the greatest weight in public perception of inflation, so their moderation helped keep overall sentiment steady.

However, beneath the surface, certain categories experienced noticeable price increases. Furniture, tires, and pet products all saw higher costs, a trend likely tied to the ongoing implementation of tariffs. While these tariffs have not yet hit consumers with their full force, the pass-through effect is starting to emerge. As David Kelly, Chief Global Strategist at JPMorgan, notes, “because importers pay the tariffs first, they appear to be shouldering most of the cost of the tariffs so far…. [but] most of the cost will, eventually, be passed on to consumers.”

Kelly also provides a longer-term outlook on inflation. Assuming no additional tariff increases or new fiscal stimulus measures, he anticipates that year-over-year CPI inflation will climb from 2.8% in July to 3.5% by the fourth quarter of 2025, before gradually easing back to 2.8% by late 2026. These projections underscore that while near-term inflation remains contained, upward pressures are likely to resurface over the next 18 months.

The tariff picture remains a moving target. New trade agreements, sector-specific exemptions, and evolving geopolitical developments make it difficult to quantify the exact inflationary impact. Each passing month, however, provides more clarity on how these measures will ripple through supply chains and consumer prices.

Monetary policy is poised to shift. The Federal Reserve is expected to cut interest rates in September and again in December, assuming no material changes in economic conditions. These rate cuts may provide a tailwind for equity markets, supporting valuations and investor sentiment. However, they could also spur additional consumer spending, potentially increasing demand and putting renewed upward pressure on prices.

Alternatively, the economy could continue expanding at a steady pace, with inflation remaining within the Fed’s target range—a scenario that would be welcomed by policymakers and markets alike. In either case, the range of possible outcomes highlights the importance of preparation and portfolio resilience.

In navigating this environment, a disciplined investment approach remains critical. Maintaining a well-diversified mix of U.S. and international assets can help balance economic risks and capture global growth opportunities. Regular portfolio rebalancing ensures allocations remain aligned with long-term objectives, avoiding unintended concentration in any one sector, style, or geography.

While inflation trends, tariff impacts, and Fed policy will continue to dominate market narratives in the months ahead, long-term investors benefit most from staying focused on fundamentals and, more importantly, staying invested. The path forward will likely feature both opportunities and challenges—but with a balanced strategy, investors can position themselves to weather volatility and participate in future growth and PDS will continue to monitor and review portfolios along the way.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.