By Kurt Brown, CFA

Posted: 08/08/2024

World markets have experienced quite the ride this past week. You’ve likely seen headlines such as “Worst One Day Return in Japan since 1987!” and the “DOW drops by over 1,000 points” to name a few. Yes, markets have taken a step back, but as of this writing, the S&P 500 is still up 10% year-to-date and 20% over the past 12 months. Even though this increased volatility can be stressful in the moment, these are normal market occurrences.

The challenging part for many investors is volatility often comes out of nowhere with very little warning as sentiment shifts. For example, just one week ago, markets had a great day by any measure with the S&P 500 jumping over 1.6%, followed by significant down days on Thursday, Friday and Monday. This was then followed by strong days on Tuesday, Wednesday, and today.

It’s difficult to pinpoint one triggering cause of the pullback, but it appears to be from a few events. The Federal Reserve elected to maintain their current rate and hinted at potentially starting to reduce interest rates in their next September meeting. This was followed by a weaker than expected jobs report and purchasing managers index on Thursday. This fueled worries from investors believing the Fed has been waiting too long to lower interest rates, which could weaken employment and eventually cause a recession. The final straw was overseas where Japan unexpectedly raised their rates causing their currency to jump and their stock market to drop by over -10%. The combinations of these items spooked US investors and caused significant selling, especially in the high-flying growth stocks.

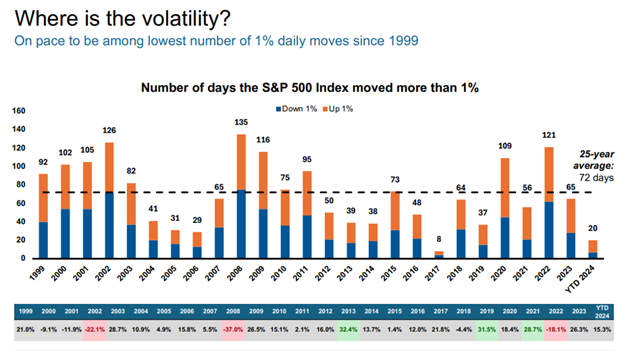

Not to completely dismiss this pullback, but markets were due for increased volatility. This chart from Russell clearly shows how the S&P was on pace to experience just about half of the historical average number of days with a greater than 1% move up or down as of 6/30/2024. The larger moves over the past few days are bringing this closer to more normal levels.

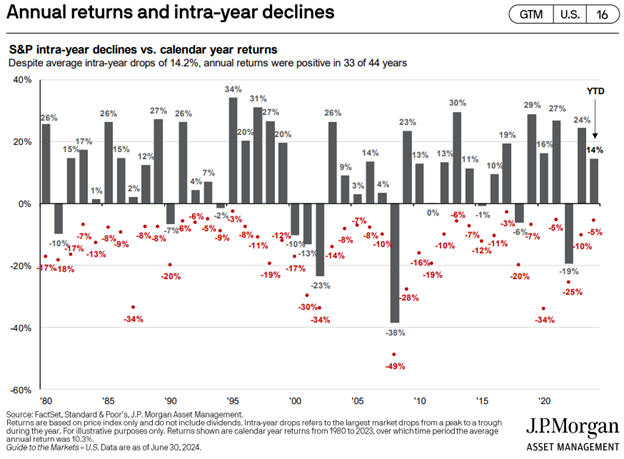

Even though pullbacks can be stressful in the moment, they can be healthy for markets. Historically, the S&P 500 experiences an intra-year drop of over -14%. For example, markets performed exceptionally well last year with a 24% calendar year return. However, many forget the S&P also fell by 10% from peak-to-trough within the year. Prior to this week, we’ve only seen a 5% pullback. Again, these are normal market occurrences.

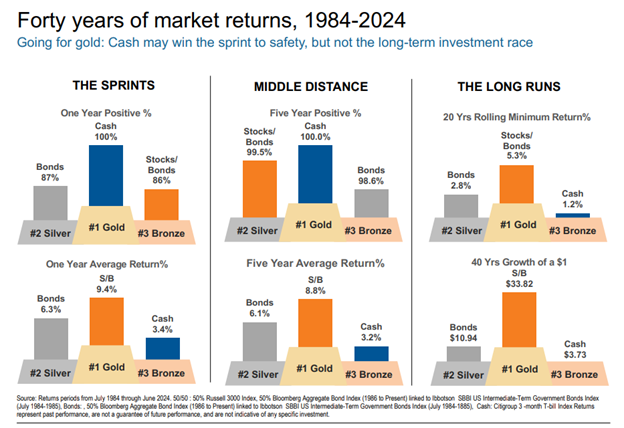

We’ll likely continue to see an increased level of volatility over the next few months but we urge clients to step back from the heat of the moment, maintain their diversified allocation, and not be tempted to go to cash. This visual is a great reminder to take a long-term perspective and to go for the gold over the long runs!

We hope you’ve been enjoying the Olympic Games with your families and wish you the best as summer wraps up and the kids go back to school!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.