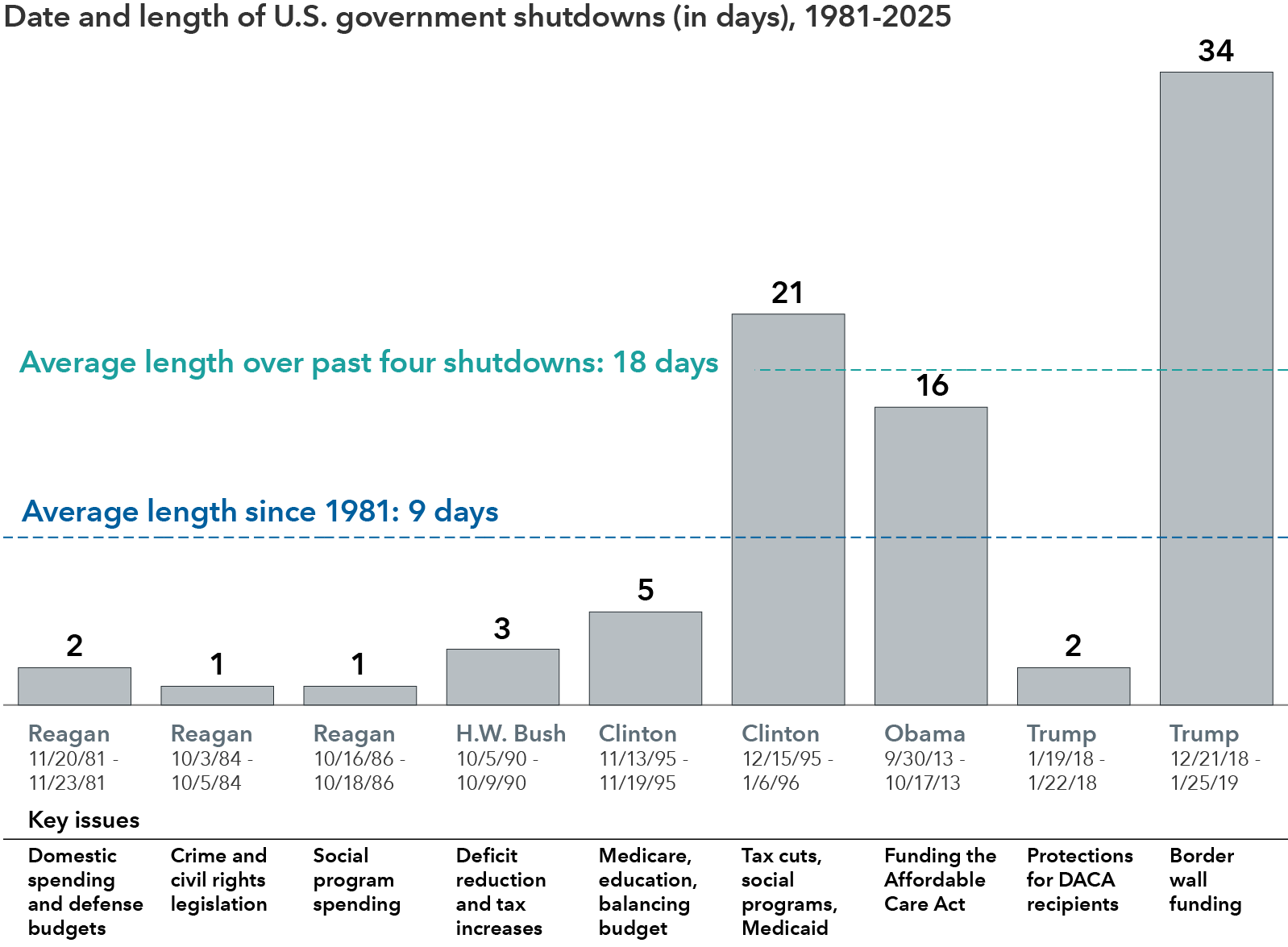

2025 has certainly experienced a significant amount of change with tariffs and trade, the Federal Reserve lowering interest rates, international stocks taking the baton from recent U.S. dominance, and most recently the U.S. government shut down amid disputes over spending priorities.

Capital Group’s political economist and former senior advisor in the White House Office of Management and Budget Matt Miller suggests, “there is no indication how long the impasse might last, but a long history of past government shutdowns suggests that, regardless of length, it will have little impact on the financial markets and the U.S. economy. Even during extended shutdowns of two weeks or longer, stocks and bonds have generally weathered the storm with only small ripple effects, followed by a strong rebound.”

“My message for investors is to stay calm and carry on. If history is any guide, the negotiations will be tense, there will be a great deal of political drama, and eventually a compromise will be reached.”

Government shutdowns have lasted an average of 9 days over the past 40 years, but more recently much longer with both sides digging in their heels. Don’t be surprised for this to impasse last awhile.

Historically, these shutdowns have had little impact on the economy. Time will tell if the administration permanently cuts a portion of the non-essential workers which could impact unemployment and consumer confidence.

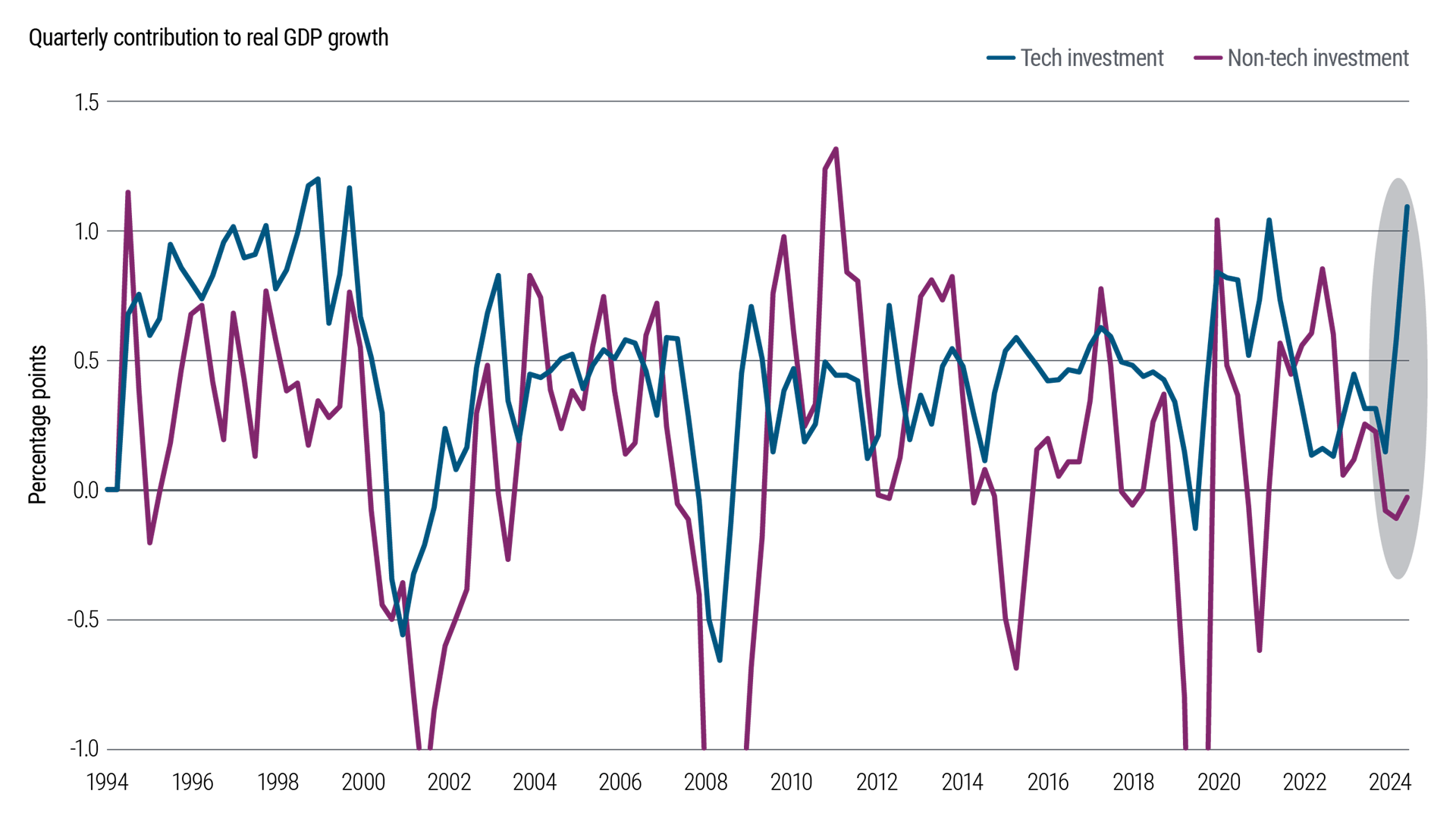

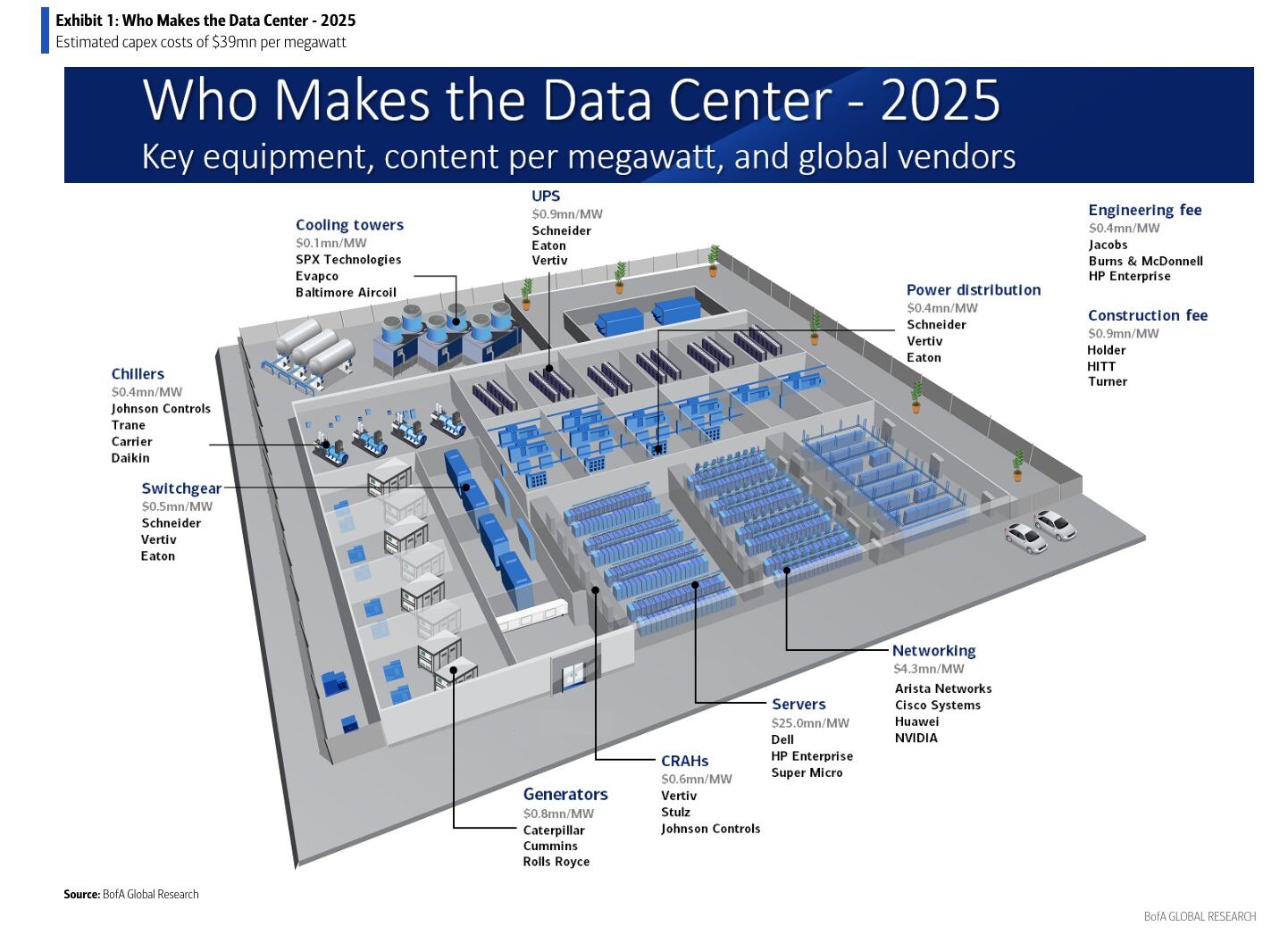

Turning to a lighter note, October means the MLB playoffs are in full force. Unfortunately, both Ohio teams made early exits in the Wild Card series, but it’s incredible to watch the fans’ enthusiasm during these games. Their passion could be likened to the recent mania around artificial intelligence. Companies across the world are jumping on the AI bandwagon and are spending at unprecedented levels. With AI adoption broadening, we’ll likely continue to see significant investment in infrastructure including data centers and specialized chips.

However, it’s not just the large players like Nvidia, Google, Meta, Oracle and OpenAI benefitting from this shift. The picks and shovels of AI provide the foundational tools, infrastructure, and technologies that drive AI’s development and adoption. For example, the chart below shows 25+ companies involved in the buildout of data centers.

Times will continue to change, but we believe the same foundational building blocks of portfolios remain: time in the market is a time tested approach to successful investing compared to trying to time the market, and diversification across stocks and bonds can provide long-term benefits. We are continuing to keep a close eye on how these types of changes impact the stock market and ultimately the impact on client portfolios. We’ve said it before, “today’s headlines and tomorrow’s reality are seldom the same”.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.