Welcome to our July 2025 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

The Great Cash Surge: A Safe Haven With Hidden Opportunity Costs

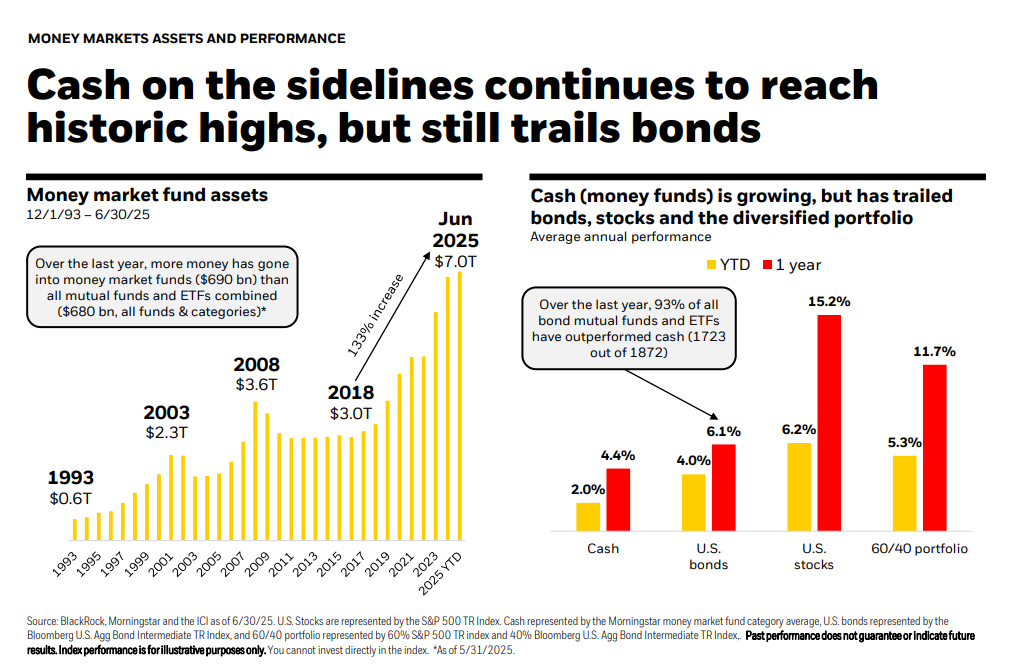

Over the last few years as interest rates have increased and the yield on cash has finally become attractive, funds have been flowing heavily into money market funds. As the chart below states, “over the last year, more money has gone into money market funds ($690 bn) than all mutual funds and ETFs combined ($680 bn).” And though cash has provided a great yield boost for very little risk, bonds, stocks, and a 60/40 portfolio have all produced better returns. Even amid trade and tariff uncertainty during 2025.

Compounding in Action

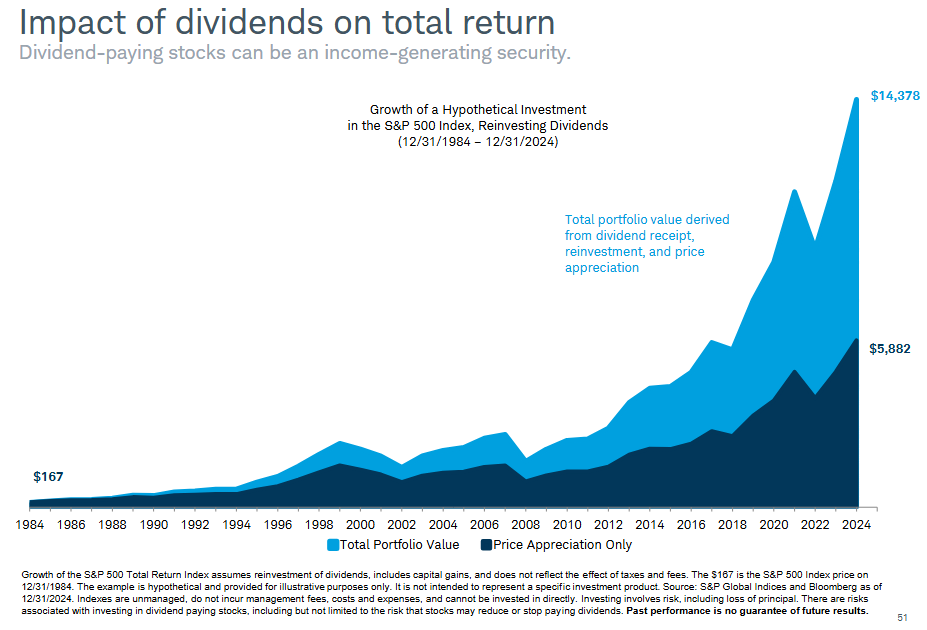

When it comes to long-term investing, one of the most consistent contributors to total return is the reinvestment of dividends. The chart below illustrates this by comparing the growth of a hypothetical $167 investment in the S&P 500 from 1984 through 2024. Without dividends, the portfolio grows to just under $6,000. But with dividends reinvested, that same investment grows to more than $14,000 — more than double the outcome. This highlights a powerful but often underappreciated driver of returns: compounding through dividend reinvestment. While cash has been attractive in the short term and market volatility can test investor patience, this chart is a clear reminder of the value of staying invested and allowing all components of return — price appreciation, income, and reinvestment — to work over time.

Not All Rate Cuts Are Equal

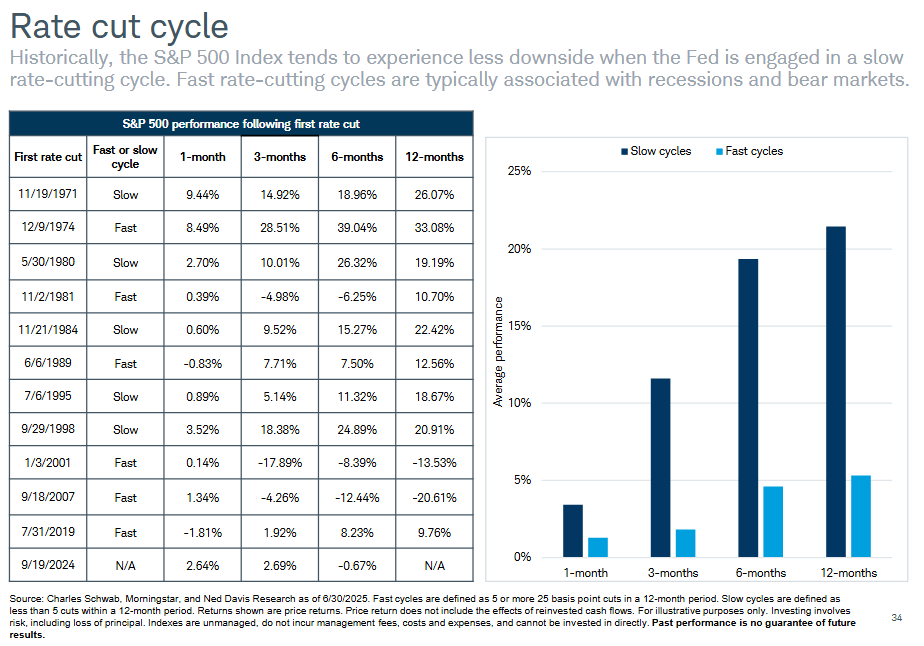

When the Fed begins cutting interest rates, the pace of those cuts can have a meaningful impact on market performance. As shown in the chart below, slow rate-cutting cycles — where the Fed moves gradually — have historically been followed by stronger equity returns, especially over 6- and 12-month periods. In contrast, fast cutting cycles tend to occur during periods of economic stress and are often associated with weaker market outcomes. While every cycle is different, this historical context helps remind investors that not all rate cuts are created equal — and that staying patient through slower, more measured cycles has tended to reward long-term investors. Today, there has been a lot of rhetoric surrounding the need to cut interest rates quickly to spur economic growth and spending forward. Perhaps slow and steady wins the race.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.