We hope you enjoyed a nice long holiday weekend with family and friends! Our kids loved the parade, likely due to the load of candy they scored. I was especially amused by the largest bag of candy handed out by a new dental practice in the area. I guess that’s one way to increase future demand for their services! We also spent the eventful weekend grilling out with friends, playing at the pool and capping it off with the local fireworks.

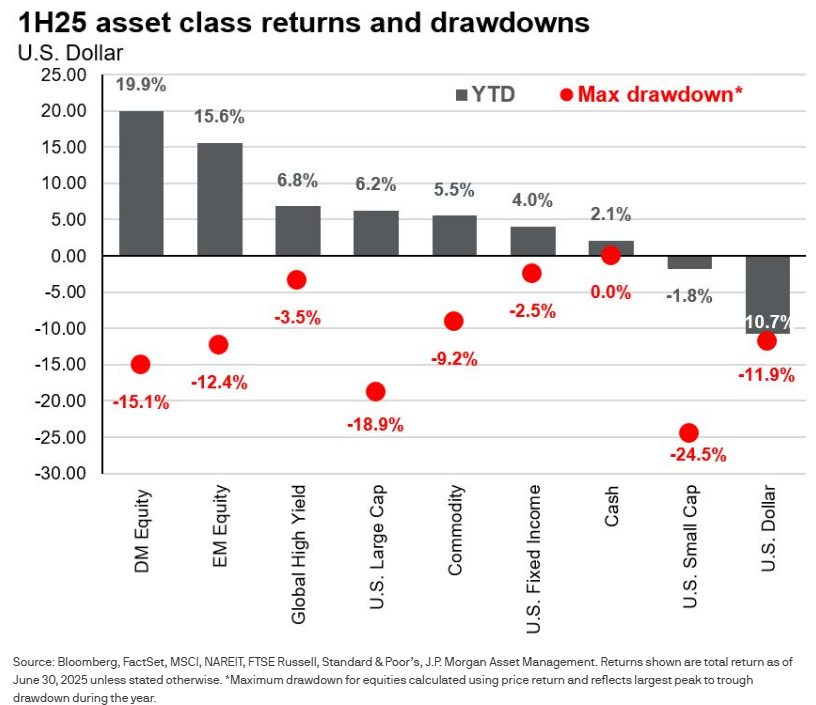

But it wasn’t just this weekend which was action-packed, the first half of the year has been quite eventful for markets. The first four months was tough for stocks as many feared the impact of tariffs, slower potential growth and higher inflation. Large cap domestic stocks fell by almost -20% and small cap by -25%. International stocks weren’t far behind with -12% to -15% pullbacks. However, this seemed to be short lived as markets raced back higher after the administration delayed tariffs and negotiated trade deals across the world.

Oil prices spiked by 30% as tensions increased with Israel and Iran, but quickly fell back to previous levels following the cease-fire deal. As this geopolitical uncertainly percolated, many investors shifted to gold as a safe haven asset as prices increased by 26% YTD and almost 40% over the past year. The US Dollar depreciated by -10% relative to a basket of other major currencies. This helped provide a significant tailwind to international stocks as they’ve led the way with near 20% gains the past six months.

Volatility has certainly been elevated this year with these events, but we see two valuable lessons: importance of diversification and staying invested for the long-term.

This chart depicts how far each asset class fell this year with the red dot, along with the actual YTD performance in the gray bars. Clearly globally diversified portfolios benefitted with the higher international returns. Bonds also helped provide stability in these times of stress. “However, the first half of 2025 also reminded investors of the importance of staying invested and not trying to time the market,” suggested JPMorgan’s Dr. David Kelly. “As shown in this chart, U.S. stocks saw major drawdowns within the first half. But, by the end of the first half, large caps had rebounded and small caps were only slightly down. Investors who stayed diversified and stayed invested fared the best in the first half of 2025.”

What an eventful year so far and early indications suggest the pace of change won’t slow. We already started July with Congress passing the administration’s big, beautiful bill to extend the tax cuts. Time will tell which industries and sectors will benefit, which will be hurt, and the impact on the deficit and growth. Tariffs are also expected to creep back into the headlines as the 90-day pause is quicky approaching for many countries. But we remind clients to stick to the tried and true principals of rebalancing, staying invested, and globally diversified through these times.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.